GOAL:

To build a low-maintenance, low-cost, moderate-growth portfolio to fund early & traditional retirement spending.

INVESTMENT STRATEGY:

- Invest in low-cost equity & bond mutual funds via 401(k)s, IRAs, and taxable accounts

- Favor equity funds (80/20) through early retirement while earned income potential is still possible in the event of a downturn

- Hold cash and bond funds for near-term expenditures

- Check up once a year; rebalance if asset allocation is greater than +/- 5 percentage points of target allocation

- In the event of a major downturn in equities; rebalance to target allocation in the event the S&P 500 declines greater than 20%

CURRENT INVESTMENTS:

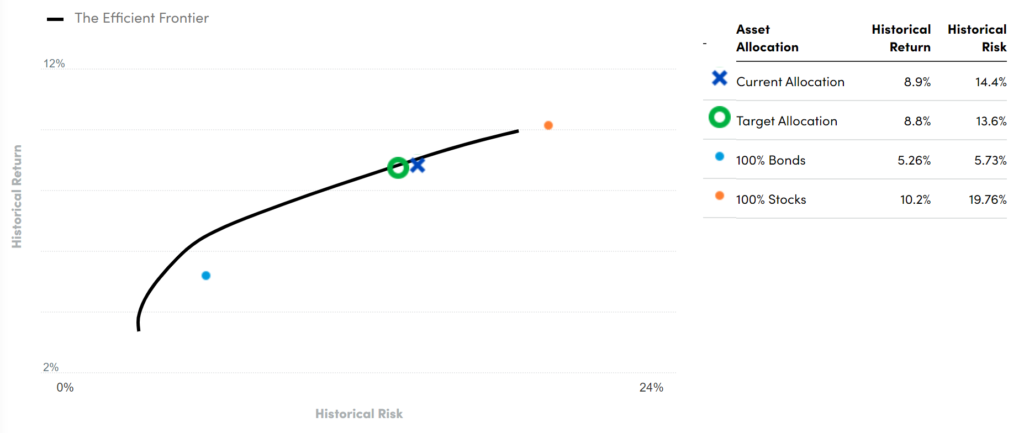

I’ve been educating myself a lot lately on the efficient frontier and trying to understand what a good mix of US & International Stock Funds with Bond Funds and Alternatives (Real Estate Investment Trusts, commodities, gold) looks like. As I understand it, the goal of targeting a point on the Efficient Frontier is two fold, first I need to select a point that achieves my desired rate of return to accomplish my goals. Secondly, I need to be comfortable with the risk/volatility I am taking to achieve the estimated annual rate of return needed to hit my goals.

I planned my future spending needs based on current & historical spending. I set a savings goal such that the annual returns should reasonably cover my annual spending using the 4% rule of thumb.

Example: To support an annual spending of $60,000, I need savings of $1,500,000, calculated by dividing the annual spending by 4% (0.04).

After identifying the total that will support my annual spending the next step is to identify the point on the efficient frontier curve that balances my comfort with volatility Vs. my desired annual rate of return and target Financial Independence date. This is a negotiation in my brain, choosing a point on the curve to the right of the graph means accepting more risk/volatility but a potentially higher rate of return and an earlier Financial Independence date. However, it also means a higher chance that a downturn in the market could significantly delay my Financial Independence Date. Choosing a point on the curve closer to the left of the graph means lower volatility/risk, but it also means you need to assume a lower annual rate of return and a later, but arguably more stable/solid, Financial Independence Date.

Example: To reach my target financial independence date of June 2023, I’m assuming a 7% annual rate of return. For a detailed breakdown, visit The Numbers page. In my analysis, the X-axis represents volatility or risk, and the Y-axis represents the rate of return or growth.

I built my spreadsheets & plan on The Numbers page assuming a more conservative 7% annual rate of return, but from the graph above you’ll notice that my actual investment mix is targeting an annual rate of return of 8.8% and volatility of 13.6%. I am still in my early 40’s and in the event of a major downturn I am comfortable working beyond my target financial independence date in 2023, so I am ok accepting the potential volatility with the possibility of higher returns.

GET TO THE POINT ALREADY!

Ok, so let’s get to the point of this section. My investment mix to achieve my desired rate of return while managing my risk/volatility is:

- US Stock Index Funds (VTSAX): 53%

- International Stock Index Funds (VTIAX): 23%

- US Bond Index Funds (VBTLX): 12%

- Alternatives: 12%

The above mix is recommended by Personal Capital and represents the green circle on the efficient frontier graph. My actual investments are slightly different and are represented by the blue X on the efficient frontier graph. I’m comfortable with my variance from the recommendation and do not plan to adjust my current allocations, but I also recognize that I’m accepting a bit more volatility with my decision.

SUMMARY:

Your Investor Policy Statement should be unique to your goals for the future. As you’ve probably noticed in reviewing my Investor Policy Statement, I heavily rely on Personal Capital and find it to be very useful for aggregating all my investments in a single platform. I have no affiliation with Personal Capital or any other financial institution or organization. Nothing in finance is guaranteed and past results are absolutely NOT indicative of future performance, so you should create your own plan and become comfortable with your decisions based on your unique personal and financial situation.

Cheers! 🍻